The Single Strategy To Use For 501 C

Wiki Article

The Of Google For Nonprofits

Table of ContentsThe Buzz on 501c3The smart Trick of Not For Profit That Nobody is Talking AboutWhat Does Non Profit Org Mean?Not known Facts About 501c3 NonprofitLittle Known Questions About 501c3.3 Simple Techniques For Irs Nonprofit SearchNot known Details About 501c3 7 Simple Techniques For Non ProfitThe Definitive Guide for Non Profit Organization Examples

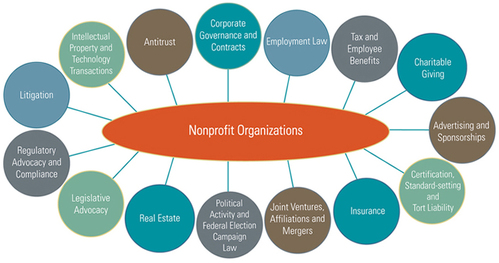

Integrated vs - non profit. Unincorporated Nonprofits When people think about nonprofits, they usually think about incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also other formally developed companies. Lots of individuals take part in unincorporated not-for-profit associations without ever realizing they have actually done so. Unincorporated not-for-profit organizations are the outcome of 2 or more individuals collaborating for the objective of supplying a public benefit or service.Exclusive structures may consist of family foundations, private operating structures, and company structures. As kept in mind over, they normally do not supply any kind of solutions and also rather make use of the funds they raise to support various other charitable companies with service programs. Exclusive foundations additionally tend to call for even more start-up funds to establish the company along with to cover legal charges as well as other continuous expenses.

7 Easy Facts About 501c3 Nonprofit Shown

The possessions remain in the trust fund while the grantor is active and also the grantor may handle the properties, such as dealing supplies or realty. All possessions transferred right into or bought by the trust fund remain in the trust with revenue dispersed to the designated beneficiaries. These trust funds can endure the grantor if they include a stipulation for continuous monitoring in the documents made use of to establish them.

What Does Not For Profit Organisation Mean?

You can hire a trust attorney to aid you develop a philanthropic trust fund and also suggest you on just how to handle it moving ahead. Political Organizations While most other types of nonprofit organizations have a minimal ability to join or supporter for political task, political organizations run under various policies.

Non Profit Org Can Be Fun For Anyone

As you assess your alternatives, make certain to talk to an attorney to determine the ideal technique for your company as well as to guarantee its appropriate configuration.There are numerous types of not-for-profit organizations. All assets and also income from the nonprofit are reinvested into the organization or given away.

8 Simple Techniques For Non Profit Organizations List

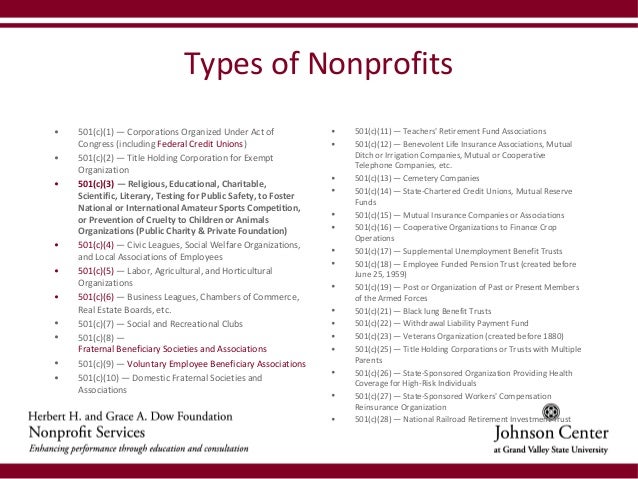

Some examples of popular 501(c)( 6) organizations are the American Farm Bureau, the National Writers Union, as well as the International Association site link of Fulfilling Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or entertainment clubs.

7 Simple Techniques For Non Profit

Usual income sources are subscription charges as well as contributions. 501(c)( 14) - State Chartered Debt Union and also Mutual Get Fund 501(c)( 14) are state chartered lending institution and also shared book funds. These organizations use go now financial services to their participants as well as the neighborhood, typically at discounted prices. Income sources are organization activities and federal government grants.In order to be qualified, at the very least 75 percent of members have to exist or past members of the USA Army. Financing comes from donations and federal government grants. 501(c)( 26) - State Sponsored Organizations Giving Health Protection for High-Risk People 501(c)( 26) are nonprofit organizations produced at the state degree to give insurance for high-risk individuals that may not be able to obtain insurance coverage with other methods.

The Only Guide to 501c3 Nonprofit

Financing comes from donations or federal government grants. Instances of states with these risky insurance policy pools are North Carolina, Louisiana, and also Indiana. 501(c)( 27) - State Sponsored Workers' Payment Reinsurance Company 501(c)( 27) not-for-profit companies are developed to provide insurance policy for employees' payment programs. Organizations that offer workers payments are needed to be a member of these organizations and also pay charges.A not-for-profit firm is an organization whose function is something other than making an earnings. 5 million nonprofit organizations signed up in the United States.

her comment is here

The 30-Second Trick For Irs Nonprofit Search

No person person or team possesses a not-for-profit. Assets from a not-for-profit can be sold, but it benefits the whole company instead of individuals. While anyone can incorporate as a not-for-profit, only those who pass the rigid criteria set forth by the government can achieve tax obligation excluded, or 501c3, condition.We discuss the steps to ending up being a not-for-profit additional into this web page.

Rumored Buzz on Not For Profit Organisation

One of the most crucial of these is the ability to get tax obligation "excluded" condition with the IRS, which allows it to receive contributions devoid of gift tax, permits contributors to deduct donations on their earnings tax returns as well as spares some of the organization's tasks from income tax obligations. Tax obligation exempt condition is really vital to lots of nonprofits as it encourages donations that can be made use of to sustain the objective of the organization.Report this wiki page